We are building the mobile bank for the next 2 Billion.

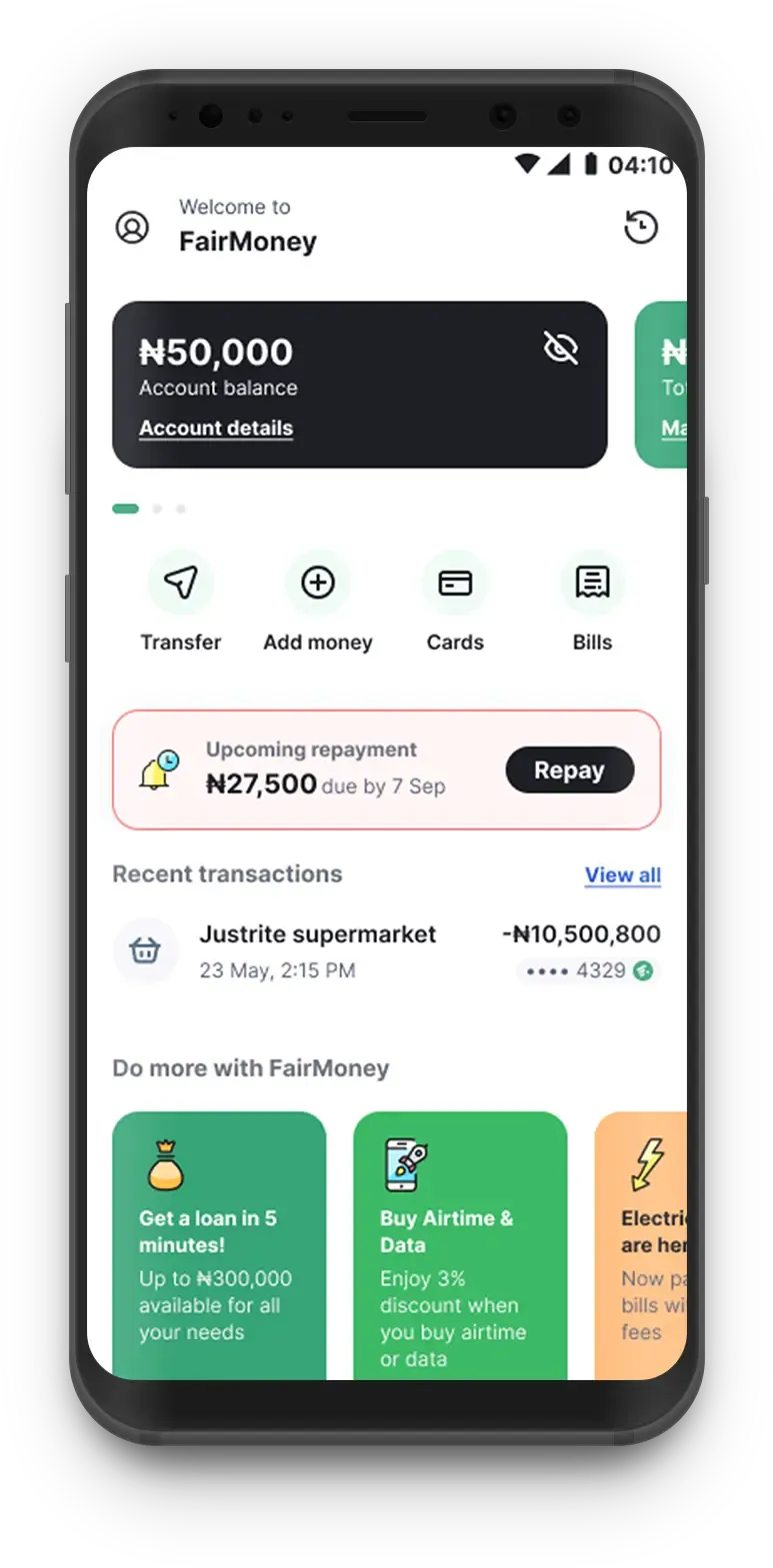

FairMoney Microfinance Bank is the number 1 most downloaded fintech app in Nigeria. With over 10,000 daily loan disbursements, and over 5 million users enjoying banking, savings, and investment services, FairMoney helps the average Nigerian access finance tools to take control of both their life and their finances.

Licensed by

Deposits Insured by

Scan the QR code with your phone camera to download the FairMoney app.

Trusted by millions of users in Nigeria

A customer base of over 5 million is a testament to the growing adoption of FairMoney's fintech solutions among Nigerians.

APP DOWNLOADS

20

million+

OVER

15,000

LOANS DISBURSED PER DAY

MORE THAN

₦35+ Billion

SAVED WITH FAIRMONEY

LOANS PROCESSED IN

5

Minutes

OVER

210,000

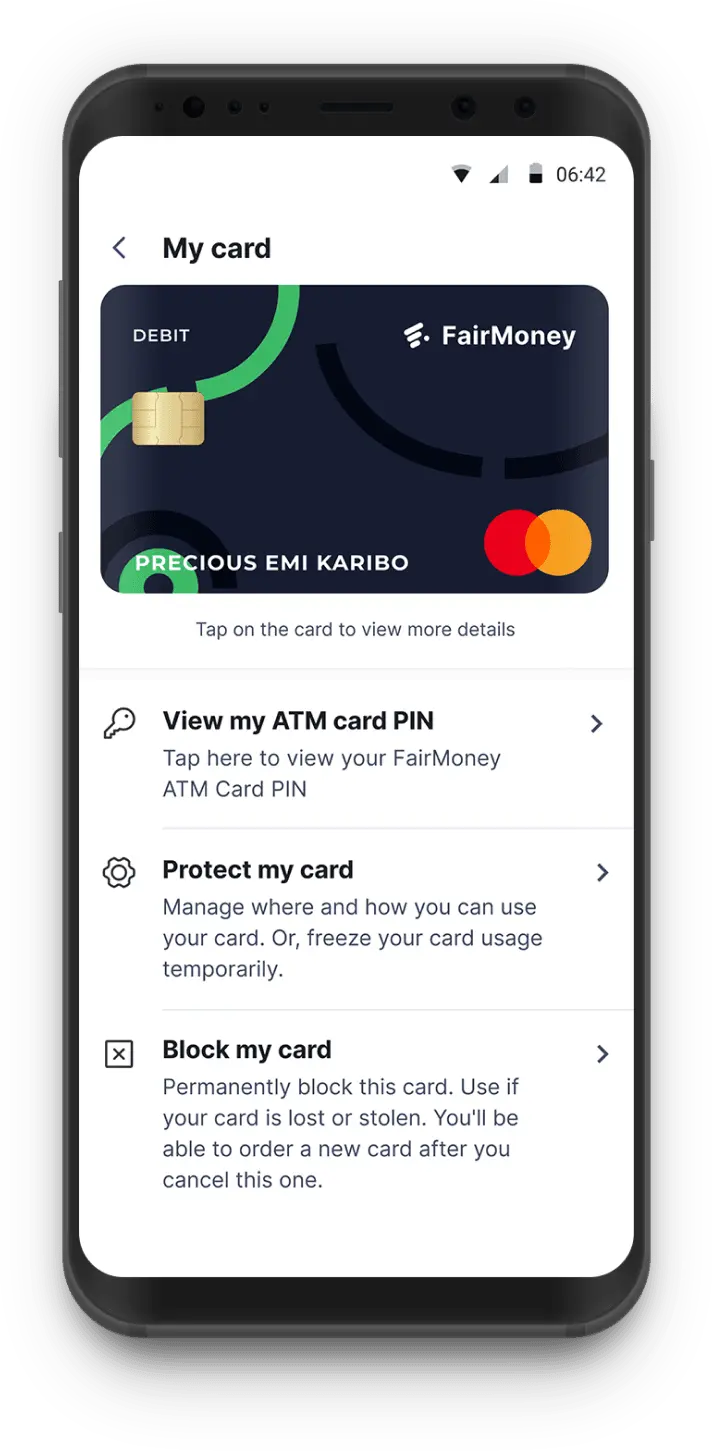

MONTHLY CARD TRANSACTIONS

Products that meet all your life goals

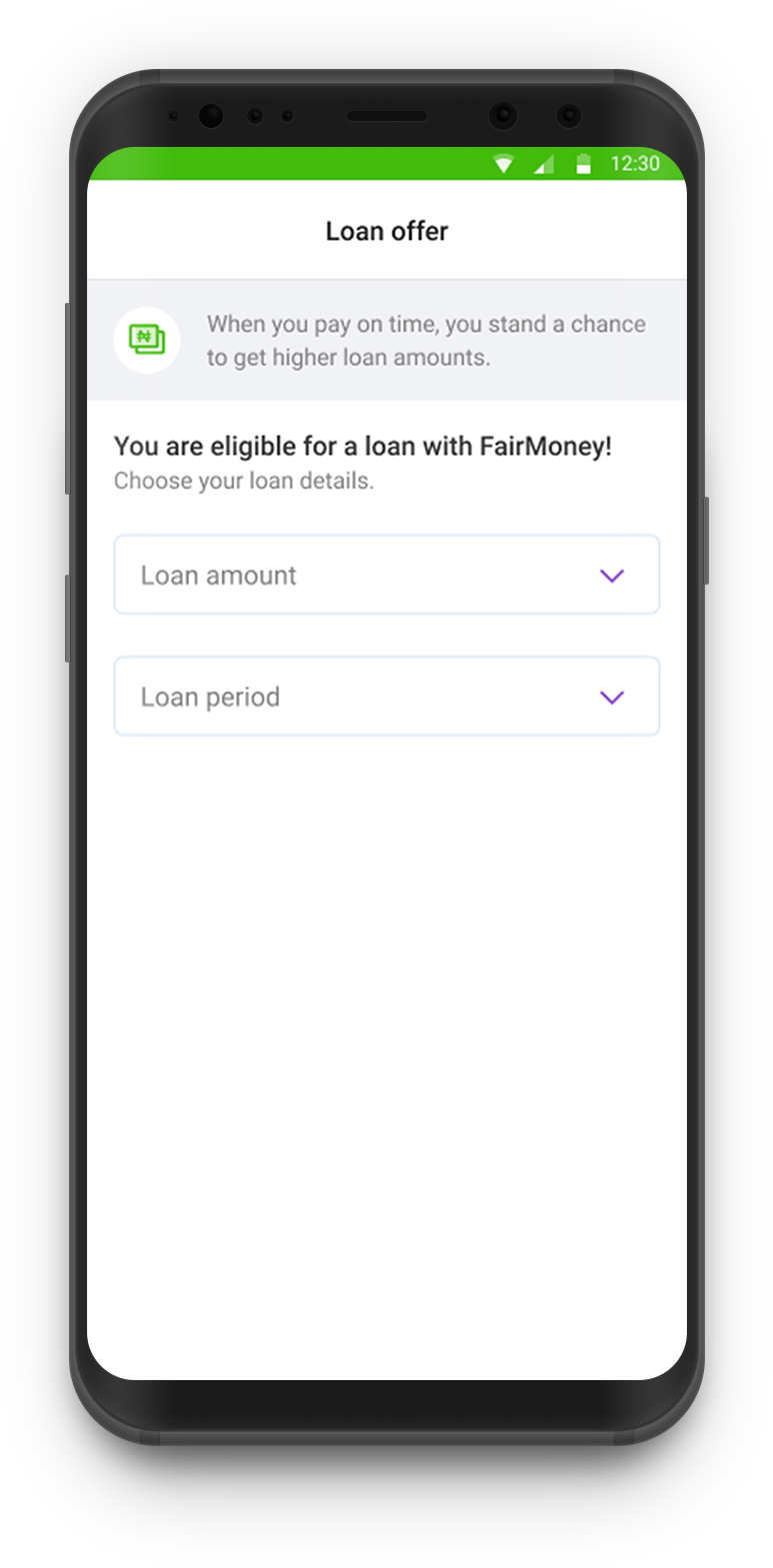

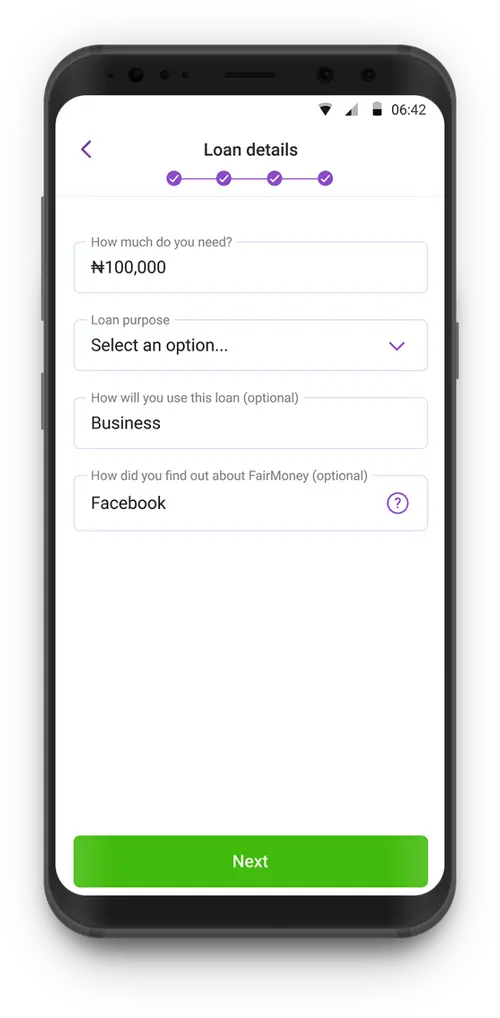

Personal Loans

You can now access quick loans of up to ₦3,000,000 in 5 mins, no collaterals & easy repayment terms!

Learn More

Business Loans

Take your business to the next level with up to ₦5,000,000 FairMoney SME loans.

Learn More

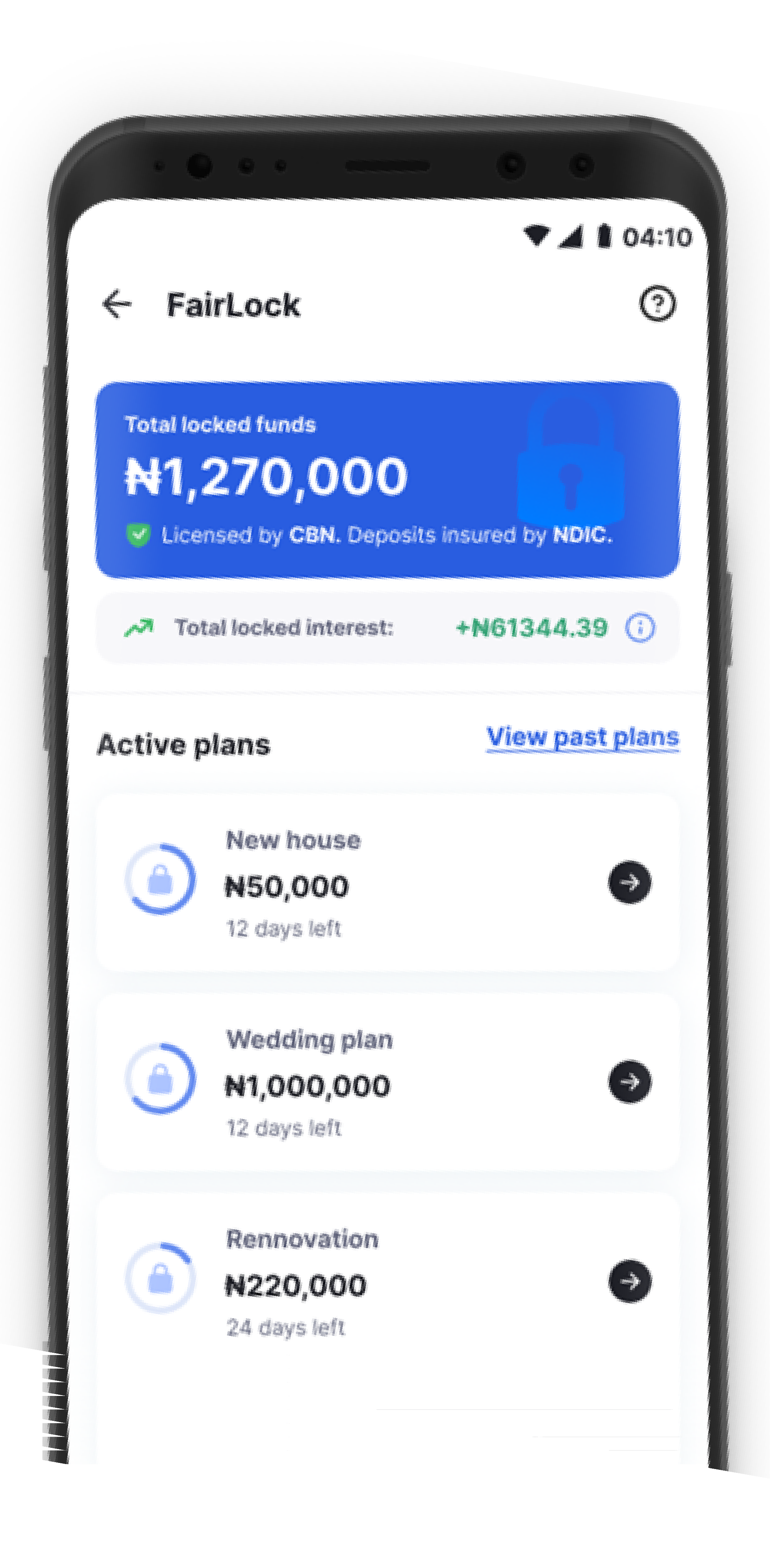

FairLock

Achieve your goals faster with FairLock (Fixed term deposits) & earn up to 28% interest P.A.

Learn More

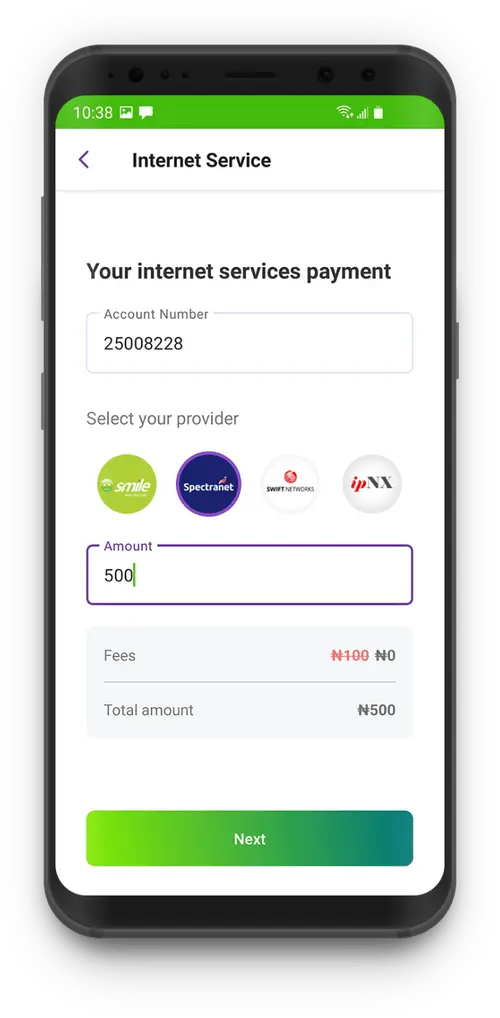

Bank Account

FairMoney offers you high savings interests, discounts on airtime/data, no charges on bills, and much more!

Learn More

POS Service

Launch your business on the Payforce network, start earning extra income and accepting payments from anywhere.

Learn More

OUR INVESTORS

Testimonials

Omolara Gbademosi

Nurse

When ASUU called off the strike and my daughter was to go back to school, the money I was expecting wasn't forthcoming and my daughter is about to graduate. It’s FairMoney loans that helped us.

I started a new business in school. It’s been going well, but I needed some money to buy things for this season. Can’t ask my parents because things are tight. I eventually used FairMoney loans, and my business has been growing.

Latest Blogs

In the News

Ready to take your finances to the next level?

Scan the QR code with your phone camera to download the FairMoney app.